Debt Consolidation Strategies: Smart Financial Choice for 2025?

Debt consolidation strategies can be a viable option to streamline your personal finances in 2025 by combining multiple debts into a single loan, potentially offering lower interest rates and simplified payments, but it requires careful evaluation to determine if it aligns with your financial situation.

Is debt consolidation strategies: is it the right choice for your personal finances in 2025? The answer isn’t always straightforward, but understanding the nuances can help you make an informed decision. Let’s dive into what you need to know.

Understanding Debt Consolidation

Debt consolidation combines multiple debts, such as credit card balances, personal loans, or medical bills, into a single new loan or credit line. This simplifies repayment and can potentially lower your interest rate, making it a popular choice for managing finances.

How Debt Consolidation Works

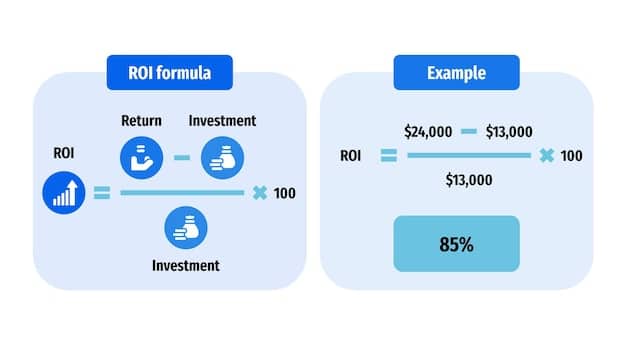

The core principle is simple: replace several debts with one. You take out a new loan or transfer balances to a credit card with a lower interest rate. This new debt is then paid off in fixed monthly installments. Understanding the mechanics of this process is key for anyone considering it.

Types of Debt Consolidation

- Personal Loans: Unsecured loans from banks or credit unions.

- Balance Transfer Credit Cards: Transferring high-interest debt to a card with a 0% introductory APR.

- Home Equity Loans: Using your home equity to secure a loan, which can offer lower interest rates but puts your home at risk.

- Debt Management Programs (DMPs): Working with a credit counseling agency to negotiate lower interest rates and create a repayment plan.

Debt consolidation offers various avenues, each with its own set of benefits and drawbacks. Evaluating these options will help you determine if this is a viable strategy for your personal finances.

Assessing Your Financial Situation

Before opting for debt consolidation, it’s crucial to evaluate your financial situation comprehensively. This assessment provides a clear understanding of your debt profile and financial habits. Ignoring this step could lead to further financial difficulties.

Calculating Your Total Debt

Start by listing all your debts, including credit card balances, student loans, personal loans, and any other outstanding obligations. Document the interest rates, minimum payments, and total amounts owed for each. Accurate figures are essential for determining the true cost of your debt.

Evaluating Your Credit Score

Your credit score plays a significant role in determining the interest rates and terms available for a consolidation loan. A higher credit score often translates to lower interest rates, making consolidation more attractive. Obtain a copy of your credit report and review it for any errors or discrepancies.

Analyzing Your Spending Habits

Examine your spending habits to identify areas where you can cut back. Debt consolidation is only effective if you address the underlying causes of your debt. Creating a budget and sticking to it can help prevent future debt accumulation.

A thorough financial assessment is the foundation for informed debt management. By understanding your debt, credit, and spending habits, you can assess whether debt consolidation aligns with your long-term financial goals.

The Pros and Cons of Debt Consolidation

Debt consolidation offers notable advantages, such as simplified payments and potentially lower interest rates. However, it also comes with potential drawbacks that require careful consideration. A balanced understanding of these pros and cons will guide you towards an informed decision.

Potential Benefits

- Simplified Payments: Combining multiple debts into a single payment makes budgeting easier.

- Lower Interest Rates: Securing a lower interest rate can reduce the total amount paid over time.

- Improved Credit Score: Consistently making on-time payments can positively impact your credit score.

- Shorter Repayment Term: Structuring the new loan with a defined repayment schedule can help accelerate debt payoff.

Potential Drawbacks

- Fees and Costs: Consolidation loans often come with origination fees, balance transfer fees, or prepayment penalties.

- Risk of Increasing Debt: If spending habits aren’t addressed, you may accumulate new debt on top of the consolidation loan.

- Longer Repayment Term: Spreading payments over a longer period may reduce monthly payments but increase total interest paid.

- Secured Debt Risks: Using a home equity loan puts your home at risk if you default on payments.

Weighing these pros and cons against your individual circumstances is essential. The best course of action depends on your ability to manage spending, the interest rates available, and your long-term financial objectives.

Debt Consolidation Strategies for 2025

In 2025, several debt consolidation strategies can be particularly effective. These strategies incorporate modern financial tools and trends to optimize debt management and achieve financial stability.

Leveraging Fintech Solutions

Fintech companies offer innovative debt consolidation options, such as peer-to-peer lending and digital personal loans. These platforms often provide competitive interest rates and flexible repayment terms. Explore these options to find the best fit for your needs.

Balance Transfer Strategies

Utilize balance transfer credit cards with 0% introductory APRs to consolidate high-interest credit card debt. Transferring balances to these cards can provide a temporary reprieve from interest charges, allowing you to pay down the principal more quickly. Be mindful of balance transfer fees and the expiration date of the introductory period.

Negotiating with Creditors

Contact your creditors to negotiate lower interest rates or payment plans. Some creditors may be willing to work with you, especially if you demonstrate a commitment to repaying your debt. A proactive approach can lead to more favorable terms and reduced financial stress.

Effective debt consolidation in 2025 requires a strategic approach, combining fintech solutions, balance transfer strategies, and proactive negotiation with creditors. Adapting these tactics to your specific financial landscape will enhance your ability to manage and eliminate debt.

Alternatives to Debt Consolidation

While debt consolidation can be an effective strategy, it’s not the only option for managing debt. Exploring alternatives may reveal solutions that better suit your financial situation and goals.

Debt Snowball Method

The debt snowball method involves paying off your smallest debts first, regardless of their interest rates. This approach provides quick wins and motivates you to continue paying down your debt. Focus your efforts on the smallest balance and once cleared, allocate that payment to the next smallest debt.

Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This approach minimizes the total interest paid over time, saving you money in the long run. While it might take longer to see initial progress, the long-term financial benefits can be substantial.

Credit Counseling

Work with a credit counseling agency to develop a debt management plan. Credit counselors can negotiate lower interest rates and create a structured repayment plan tailored to your financial situation. A combination of guidance and accountability can result in effective debt management.

Considering these alternatives will give you a more comprehensive view of debt management. Evaluating each option based on your priorities, financial habits, and long-term goals will help you choose the most effective path to financial freedom.

Making the Right Choice for Your Finances

Deciding whether debt consolidation is the right choice for your personal finances in 2025 requires careful consideration of various factors. Aligning your debt management strategy with your unique financial situation and goals is essential.

Consider Your Long-Term Goals

Align your debt management strategy with your long-term financial goals, such as saving for retirement, buying a home, or starting a business. Debt consolidation should complement these goals, not hinder them. Ensure that your chosen strategy allows you to progress towards your broader financial objectives.

Seek Professional Advice

Consult a financial advisor or credit counselor to gain personalized advice and guidance. These professionals can assess your financial situation, provide tailored recommendations, and help you navigate the complexities of debt management. Their expertise can be invaluable in making informed decisions.

Regularly Monitor Your Progress

Once you’ve implemented a debt management strategy, regularly monitor your progress and make adjustments as needed. Track your debt balances, interest rates, and payment schedules to ensure that you’re on track to achieve your goals. Adapt your approach in response to changing financial circumstances.

Making the right choice involves a comprehensive approach, encompassing long-term goal alignment, professional guidance, and continuous monitoring. By taking these steps, you can optimize your debt management strategy and secure your financial future.

| Key Point | Brief Description |

|---|---|

| 💡Consolidation | Combines debts into one for simplified payment. |

| 📊Assessment | Evaluate total debt, credit score, and spending habits. |

| ✅Benefits | Simplifies payments and potentially lowers interest rates. |

| 🤔Alternatives | Consider debt snowball, avalanche, or credit counseling. |

Frequently Asked Questions

▼

Debt consolidation combines multiple debts into a single new loan or credit line. This simplifies repayment and can potentially lower your interest rate, making it a popular choice for managing finances.

▼

Consolidating debt can have mixed effects on your credit score. While opening a new account might initially lower your score, consistently making on-time payments can improve it over time.

▼

Common types include personal loans, balance transfer credit cards, home equity loans, and debt management programs. Each option has its own terms, interest rates, and eligibility requirements to consider.

▼

Potential risks include fees and costs, the risk of increasing debt if spending habits aren’t addressed, longer repayment terms with potentially more total interest paid, and the risk of losing your home with secured debt.

▼

It might not be a good idea if you can’t secure a lower interest rate, have poor spending habits, or risk losing significant assets like your home. Alternatives such as debt snowball or avalanche methods may be more suitable.

Conclusion

In conclusion, deciding whether debt consolidation strategies: is it the right choice for your personal finances in 2025? requires a personalized assessment of your financial situation, habits, and goals. While it offers benefits such as simplified payments and potentially lower interest rates, it also comes with risks that need careful consideration. Weighing the pros and cons, exploring alternatives, and seeking professional advice will empower you to make an informed decision that aligns with your financial well-being.