Housing Market Cools as Mortgage Rates Hit 7%: New Data Analysis

New data indicates a cooling trend in the US housing market as mortgage rates rise to 7%, impacting affordability and potentially leading to shifts in buyer behavior and housing prices.

The latest figures paint a picture of a changing landscape in the US housing market. New data: Housing Market Shows Signs of Cooling as Mortgage Rates Rise to 7%, marking a potential turning point after years of heated competition and rising prices.

Understanding the Housing Market Shift

The housing market is a complex ecosystem influenced by various economic factors. With mortgage rates climbing to 7%, it’s crucial to understand the dynamics at play and how this shift might affect both buyers and sellers.

Rising mortgage rates directly impact affordability, making it more expensive for individuals to purchase homes. This can lead to a decrease in demand, subsequently affecting housing prices and market activity.

The Impact of Mortgage Rate Hikes

Mortgage rate increases have a ripple effect throughout the housing market. Here’s a breakdown of the immediate consequences:

- Reduced Buyer Affordability: Higher rates translate to larger monthly mortgage payments, squeezing potential buyers’ budgets.

- Decreased Demand: As affordability declines, fewer people can afford to enter the market, leading to a drop in demand.

- Slower Price Appreciation: With less demand, sellers may need to lower their prices to attract buyers, slowing down or even reversing price appreciation.

These factors combined create a cooling effect on the housing market, shifting the balance of power from sellers to buyers.

Analyzing the New Data

Recent data releases provide valuable insights into the current state of the housing market. By examining key indicators, we can gain a better understanding of the extent of the cooling trend.

Key metrics such as pending home sales, inventory levels, and price reductions offer a comprehensive view of market dynamics and potential future trends.

Key Indicators to Watch

Several key indicators can provide early signals of a cooling housing market:

- Pending Home Sales: A decrease in pending home sales suggests fewer buyers are committing to purchases.

- Inventory Levels: An increase in the number of homes for sale gives buyers more options and reduces competition.

- Price Reductions: More sellers reducing their prices indicates a need to attract buyers in a less competitive market.

By monitoring these indicators, both buyers and sellers can make more informed decisions.

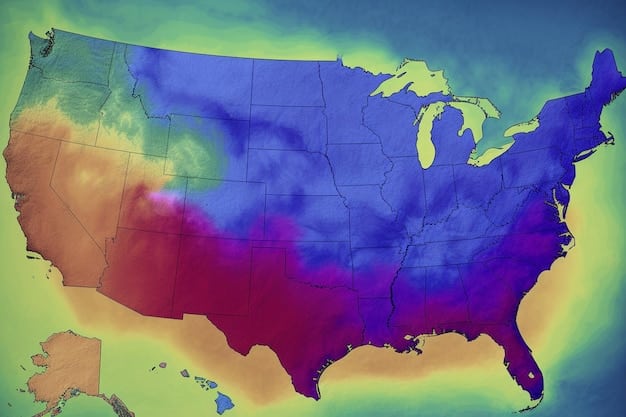

Regional Variations in the Housing Market

The housing market is not monolithic; regional variations can significantly impact local conditions. Some areas may experience a more pronounced cooling effect than others.

Factors such as local economies, job growth, and population shifts play a role in determining how individual markets respond to rising mortgage rates.

Factors Influencing Regional Differences

Several factors contribute to the variations seen across different housing markets:

Local Economic Conditions: Strong local economies with robust job markets tend to be more resilient.

Population Growth: Areas experiencing rapid population growth may see continued demand despite higher rates.

Housing Supply: Regions with limited housing supply may maintain higher prices even with decreased demand.

Understanding these regional nuances is crucial for anyone looking to buy or sell property.

Strategies for Buyers in a Cooling Market

A cooling housing market presents unique opportunities for buyers. With less competition, buyers can take their time, negotiate better deals, and find properties that truly meet their needs.

By being strategic and informed, buyers can leverage the changing market conditions to their advantage.

Tips for Navigating a Cooling Market

Here are some strategies for buyers in a cooling market:

- Take Your Time: Don’t feel pressured to make quick decisions.

- Negotiate: Be prepared to negotiate on price and other terms.

- Consider Contingencies: Include contingencies in your offer to protect yourself.

With patience and careful planning, buyers can find great opportunities in a slowing market.

Strategies for Sellers in a Cooling Market

For sellers, a cooling market requires a different approach. It’s essential to price properties competitively, enhance their appeal, and be patient as the market adjusts.

By understanding the changing dynamics, sellers can still achieve successful outcomes.

Adapting to Market Conditions

Here are some strategies for sellers in a cooling market:

Price Competitively: Set a realistic price based on current market conditions.

Enhance Curb Appeal: Make sure your property is visually appealing to attract buyers.

Be Patient: It may take longer to sell your property in a cooling market.

With the right strategies, sellers can still navigate the market effectively.

Long-Term Implications of Rising Mortgage Rates

The rise in mortgage rates has broader implications for the economy and the housing market’s long-term health. Understanding these implications is crucial for making informed financial decisions.

The current trends could lead to a more sustainable and balanced housing market in the long run.

Looking Ahead

The long-term implications include:

Market Stabilization: Cooling can help prevent unsustainable price bubbles.

Increased Affordability: As prices moderate, homeownership may become more accessible.

Shifting Market Dynamics: A move towards a more balanced market benefits both buyers and sellers.

These factors suggest a potentially healthier and more sustainable housing market in the future.

| Key Point | Brief Description |

|---|---|

| 📉 Mortgage Rates Rise | Mortgage rates have increased to 7%, affecting affordability. |

| 🏠 Cooling Market | Housing market shows signs of slowing down. |

| 💰 Buyer Strategies | Buyers can negotiate and take their time. |

| 📈 Seller Strategies | Sellers should price competitively and enhance curb appeal. |

Frequently Asked Questions

▼

Rising mortgage rates increase the cost of borrowing, leading to higher monthly payments. This reduces the amount potential buyers can afford, making homeownership less accessible.

▼

Signs include decreased pending home sales, increased inventory levels, and more price reductions. These indicators suggest a shift towards a buyer’s market.

▼

Buyers can take their time to find the right property, negotiate prices and terms, and include contingencies in their offers for added protection.

▼

Sellers should price their properties competitively, enhance curb appeal to attract buyers, and be patient as the market adjusts to slower sales.

▼

Long-term implications include market stabilization, increased affordability as prices moderate, and a shift towards a more balanced and sustainable housing market.

Conclusion

The current data indicating a cooling housing market as mortgage rates rise to 7% suggests a significant shift in the real estate landscape. Both buyers and sellers need to adapt their strategies to navigate these changing conditions effectively. Staying informed and making strategic decisions will be key to success in this evolving market.