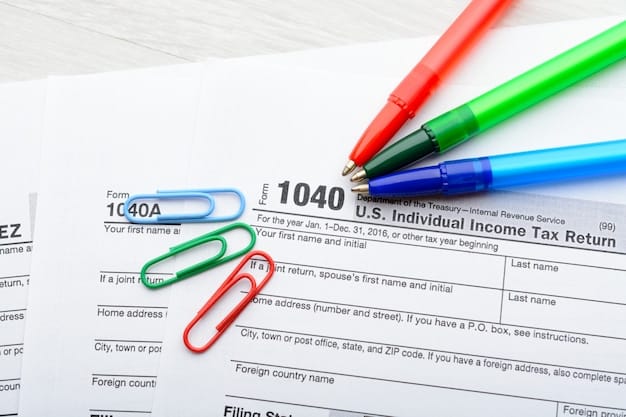

Maximize Your Giving: Understanding Qualified Charitable Distributions (QCDs)

Qualified Charitable Distributions (QCDs) allow individuals aged 70½ and older to donate directly from their IRA to qualified charities, potentially reducing their taxable income and fulfilling their philanthropic goals in a tax-efficient manner.

Are you looking for a smart way to give back to your favorite charities while also reducing your tax burden? Qualified Charitable Distributions (QCDs) might be the perfect solution for you. Let’s explore how you can leverage QCDs to make a difference and benefit financially.

Understanding Qualified Charitable Distributions (QCDs)

A qualified charitable distribution (QCD) is a direct transfer of funds from your IRA (other than a SEP or SIMPLE IRA) to a qualified charity. This can be a powerful tool for individuals age 70½ or older who are looking to donate to charity in a tax-efficient way. By understanding the ins and outs of QCDs, you can maximize your giving and potentially lower your tax bill.

While QCDs provide a valuable opportunity for charitable giving, it is important to know who can benefit from it. Here are the basic rules and requirements:

Who Can Benefit from QCDs?

- Age Requirement: You must be age 70½ or older at the time of the distribution.

- IRA Requirement: The funds must come from a traditional IRA (excluding SEP or SIMPLE IRAs).

- Charity Qualification: The donation must be made directly to a qualified charity.

These requirements ensure that QCDs are used by the intended demographic and for legitimate charitable purposes.

Benefits of Using QCDs

There are several compelling reasons to consider using QCDs for your charitable giving.

- Tax Reduction: QCDs are not included in your adjusted gross income (AGI), which can lower your overall tax liability.

- Fulfilling RMD: A QCD can satisfy your required minimum distribution (RMD) for the year.

- No Itemization Required: You can take advantage of the tax benefits of charitable giving without itemizing deductions.

QCDs offer a unique way to support your favorite causes while also optimizing your financial situation.

In conclusion, qualified charitable distributions are a valuable tool for eligible individuals looking to donate to charity in a tax-efficient manner. By meeting the age and IRA requirements and donating to a qualified charity, you can enjoy significant tax benefits and make a meaningful impact.

Eligibility Requirements for QCDs

To take advantage of qualified charitable distributions, it’s crucial to understand and meet the specific eligibility requirements. These rules ensure that only those who meet the criteria can claim the tax benefits associated with QCDs. Let’s delve into the details of these requirements to help you determine if you qualify.

Age and IRA Type

The first eligibility requirement is based on age and the type of IRA you hold.

- Age 70½ or Older: You must be at least 70½ years old at the time of the distribution.

- Traditional IRA: The funds must come from a traditional IRA. SEP and SIMPLE IRAs are not eligible.

- Beneficiary IRA: QCDs are generally not allowed from beneficiary IRAs.

These stipulations are critical for determining if you meet the basic criteria for making a QCD.

Qualified Charities

The recipient of the distribution must be a qualified charity as defined by the IRS.

- 501(c)(3) Organizations: The charity must be a tax-exempt 501(c)(3) organization.

- Ineligible Organizations: Donations to private foundations or supporting organizations do not qualify.

- Documentation: Keep records of your donations to prove their legitimacy.

Ensuring that your donation goes to a qualified charity is essential for the QCD to be valid.

Other Key Requirements

Beyond age and charity qualifications, there are additional factors to consider.

- Direct Transfer: The distribution must be transferred directly from your IRA to the charity.

- Annual Limit: The maximum QCD amount is generally $100,000 per individual per year.

- No Benefit to Donor: You cannot receive any benefit in return for the donation.

These additional requirements ensure that QCDs are used for genuine charitable giving purposes.

In summary, meeting the eligibility requirements for qualified charitable distributions is essential for claiming the associated tax benefits. By ensuring you meet the age and IRA requirements, donate to a qualified charity, and adhere to the guidelines for direct transfers and donation limits, you can effectively use QCDs to support your favorite causes while benefiting from tax savings.

How QCDs Can Fulfill Your RMD

One of the significant advantages of qualified charitable distributions (QCDs) is their ability to satisfy your Required Minimum Distribution (RMD). For individuals who are subject to RMDs, QCDs offer a way to reduce their tax burden while still meeting their distribution requirements. Let’s explore how this works and why it can be a beneficial strategy.

Understanding RMDs

Before delving into how QCDs can fulfill RMDs, it’s important to understand what RMDs are.

- Definition: RMDs are the minimum amounts you must withdraw from your retirement accounts each year, starting at age 73 (or 75, depending on your birth year).

- Calculation: The RMD amount is calculated by dividing your prior year-end IRA balance by your life expectancy factor.

- Tax Implications: RMDs are taxed as ordinary income, potentially increasing your tax liability.

Understanding these key aspects of RMDs sets the stage for seeing how QCDs can be used strategically.

Using QCDs to Satisfy RMDs

QCDs can be used to satisfy your RMD, providing significant tax benefits.

- Direct Distribution: A QCD is a direct transfer from your IRA to a qualified charity.

- Tax Exclusion: The amount distributed as a QCD is excluded from your adjusted gross income (AGI).

- RMD Fulfillment: The QCD amount counts toward your RMD for the year, reducing the taxable portion of your distribution.

This approach allows you to meet your RMD while also supporting your favorite charities in a tax-efficient manner.

Benefits of Fulfilling RMDs with QCDs

Using QCDs to fulfill your RMD offers several advantages.

- Lower Taxable Income: By excluding the QCD amount from your AGI, you can lower your overall tax liability.

- Reduced Tax Bracket: Lowering your AGI may also help you stay in a lower tax bracket.

- No Itemization Required: You can benefit from charitable giving without needing to itemize deductions.

QCDs can be a powerful tool for managing your RMDs and tax obligations.

In conclusion, using qualified charitable distributions to fulfill your Required Minimum Distribution can be a smart strategy to reduce your tax burden while supporting charitable causes. By understanding the mechanics of RMDs and how QCDs can be used to satisfy them, you can make informed decisions that benefit both your financial situation and the charities you care about.

Tax Benefits of Using QCDs

The tax advantages of using qualified charitable distributions (QCDs) are a primary reason why many eligible individuals choose this method for their charitable giving. Beyond the simple act of donating, QCDs offer several opportunities to reduce your taxable income and potentially lower your overall tax liability. Let’s explore the specific tax benefits associated with QCDs.

Exclusion from Adjusted Gross Income (AGI)

One of the most significant tax benefits of QCDs is the exclusion from Adjusted Gross Income (AGI).

- Non-Taxable Distribution: A QCD is not included in your AGI, meaning it is not considered taxable income.

- Lower AGI: A lower AGI can impact other tax-related calculations, such as eligibility for certain deductions and credits.

- Reduced Tax Liability: By reducing your AGI, you can potentially lower your overall tax liability.

This exclusion is a key factor in making QCDs an attractive option for charitable giving.

Meeting RMD Requirements Tax-Efficiently

As mentioned earlier, QCDs can also be used to fulfill Required Minimum Distribution (RMD) requirements in a tax-efficient manner.

- Fulfilling RMD: The amount distributed as a QCD counts toward your RMD for the year.

- Tax Exclusion: The QCD amount is excluded from your AGI, unlike regular RMD withdrawals.

- Reduced Tax Impact: This can significantly reduce the tax impact of your RMD.

This combination of RMD fulfillment and tax exclusion makes QCDs a valuable tool for managing your retirement distributions.

No Itemization Required

Another benefit of QCDs is that you don’t need to itemize deductions to receive the tax benefits.

- Standard Deduction: Even if you take the standard deduction, you can still benefit from the AGI exclusion.

- Simplified Tax Filing: This simplifies your tax filing process, as you don’t need to track and calculate itemized deductions.

- Wider Benefit: This benefit is particularly advantageous for those who don’t have enough itemized deductions to exceed the standard deduction.

This feature makes QCDs accessible to a wider range of taxpayers.

As a summary,

| Key Point | Brief Description |

|---|---|

| 🎁 QCD Definition | Direct IRA transfer to charity. |

| 🏛️ Eligibility | Age 70½+, traditional IRA. |

| 💰 Tax Benefit | Excludes from AGI, lowers taxes. |

| ✅ RMD Fulfillment | Counts towards required distributions. |

FAQ About Qualified Charitable Distributions

▼

Generally, the maximum QCD amount is $100,000 per individual per year. This limit can sometimes be adjusted for inflation, so it’s wise to verify the current limit annually.

▼

No, qualified charitable distributions must come from a traditional IRA. Roth IRAs cannot be used for QCDs. However, you can convert funds from a traditional IRA to a Roth IRA and then donate.

▼

No, one of the great benefits of a QCD is that you don’t need to itemize deductions to claim the tax benefits. The QCD is excluded from your adjusted gross income (AGI), lowering your overall tax liability regardless of whether you itemize.

▼

No, the donation must be made to a qualified charity, which is typically a 501(c)(3) organization. Donations to private foundations or supporting organizations generally do not qualify for QCD treatment.

▼

If you’ve already taken your RMD for the year, you can still make a QCD, but it won’t change the taxability of the RMD you’ve already taken. It’s best to plan your QCD before taking your RMD to maximize tax benefits.

Conclusion

In conclusion, qualified charitable distributions (QCDs) offer a powerful and tax-efficient way to support your favorite charities while managing your retirement distributions. By understanding the eligibility requirements and tax benefits, you can make informed decisions that benefit both your financial situation and the causes you care about.