Financial Independence, Retire Early (FIRE): Your Roadmap to Freedom

Financial Independence, Retire Early (FIRE) is a movement focused on aggressive savings and investments to achieve financial freedom and retire much earlier than traditional retirement age.

The Financial Independence, Retire Early (FIRE) movement is sparking interest among those seeking to break free from the conventional 9-to-5 grind. This guide offers a realistic roadmap to achieving financial freedom, exploring the strategies and mindset needed to retire early and live life on your own terms.

Understanding the FIRE Movement

The FIRE movement isn’t just about retiring young; it’s about gaining control over your time and resources. It involves making deliberate choices to save a significant portion of your income, invest wisely, and reduce your expenses, ultimately leading to financial independence.

Let’s delve deeper into the core tenets of this increasingly popular approach to personal finance.

Core Principles of FIRE

At its heart, the FIRE movement is built on a few key tenets that drive individuals toward financial freedom. These principles provide a foundation for making informed decisions and staying committed to the long-term goal of early retirement.

- Aggressive Saving: Saving a substantial portion of your income, often exceeding 50%, is crucial.

- Strategic Investing: Investing those savings wisely to generate passive income and growth.

- Expense Minimization: Identifying and cutting unnecessary expenses to maximize savings.

Understanding and implementing these core principles is the first step toward achieving FIRE. It requires a shift in mindset and a willingness to prioritize long-term financial security over short-term gratification.

Assessing Your Current Financial Situation

Before embarking on your FIRE journey, it’s essential to take a close look at your current financial situation. This involves understanding your income, expenses, assets, and liabilities.

Let’s explore how to gain a clear picture of where you stand financially.

Calculating Your Net Worth

Your net worth is a snapshot of your financial health. It is calculated by subtracting your total liabilities (debts) from your total assets (what you own). A positive net worth indicates that you own more than you owe, while a negative net worth suggests the opposite.

To accurately calculate your net worth, gather information about all your assets and liabilities, including:

- Assets: Cash, stocks, bonds, real estate, retirement accounts, and other investments.

- Liabilities: Mortgages, student loans, credit card debt, and other outstanding debts.

Tracking your net worth over time is a great way to see how far you’ve come in achieving your financial goals.

Tracking Your Expenses

Understanding where your money goes each month is vital for identifying areas where you can cut back and increase your savings rate. There are several tools and methods available for tracking your expenses, including:

- Budgeting Apps: Apps like Mint, YNAB (You Need a Budget), and Personal Capital can help you track your spending automatically.

- Spreadsheets: Creating a simple spreadsheet to manually record your income and expenses.

- Budgeting Methods: Trying methods like the 50/30/20 rule for organizing your finances.

Accurate expense tracking provides valuable insights into your spending habits and helps you make informed decisions about where to allocate your resources.

In conclusion, a clear understanding of your current financial situation—including net worth and spending habits—is the bedrock upon which you can build your FIRE strategy.

Setting Realistic FIRE Goals

Setting clear and achievable goals is a critical step in your FIRE journey. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). By defining your objectives, you’ll have a roadmap to guide your decisions and stay motivated.

Now, let’s explore how to set realistic and meaningful goals for achieving financial independence.

Determining Your FIRE Number

Your FIRE number is the amount of money you need to accumulate in order to retire early and live comfortably. A common rule of thumb for calculating your FIRE number is the 4% rule, which suggests that you can safely withdraw 4% of your portfolio each year without running out of money.

To determine your FIRE number, estimate your annual expenses in retirement and multiply that number by 25. For example, if you estimate that you’ll need $50,000 per year to live comfortably in retirement, your FIRE number would be $1.25 million ($50,000 x 25).

Choosing a FIRE Strategy

There are several variations of the FIRE movement, each with its own approach to achieving financial independence. Some popular FIRE strategies include:

- Lean FIRE: Focuses on extreme frugality and minimizing expenses to achieve a lower FIRE number.

- Fat FIRE: Aims for a more luxurious retirement with higher expenses and a larger FIRE number.

- Barista FIRE: Combines part-time work or side hustles with investment income to provide a cushion during early retirement.

Choosing a FIRE strategy that aligns with your values and lifestyle is essential for long-term success and happiness.

In summary, setting realistic FIRE goals involves determining your FIRE number and choosing a FIRE strategy that is in line with your preferences and values.

Developing a Savings and Investment Plan

A well-designed savings and investment plan is the engine that drives your FIRE journey. It involves creating a budget, increasing your savings rate, and investing your money wisely to generate passive income and long-term growth.

Let’s explore the key elements of a successful savings and investment plan.

Increasing Your Savings Rate

The higher your savings rate, the faster you’ll reach financial independence. Here are some strategies for boosting your savings rate:

- Track Your Spending: Identify areas where you can cut back on expenses.

- Automate Savings: Set up automatic transfers from your checking account to your savings or investment accounts.

- Increase Income: Look for opportunities to earn more money through promotions, side hustles, or freelance work.

Even small increases in your savings rate can have a significant impact on your timeline to FIRE.

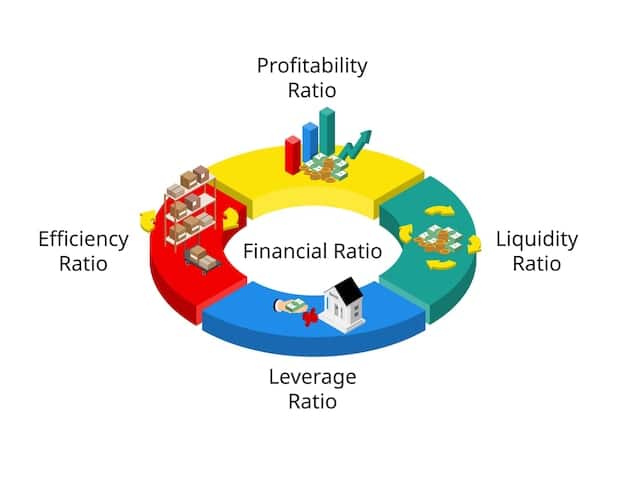

Diversifying Your Investments

Diversification is a key principle of investing. It involves spreading your money across different asset classes, such as stocks, bonds, real estate, and commodities, to reduce risk. A well-diversified portfolio can help you weather market volatility and achieve consistent returns.

Consider investing in:

- Index Funds: Low-cost funds that track a specific market index, such as the S&P 500.

- Bonds: Investments that provide a fixed income stream and are generally less volatile than stocks.

- Real Estate: Investing directly or through Real Estate Investment Trusts (REITs).

In conclusion, a robust savings and investment plan, including strategies for increasing your savings rate and diversifying your investments, is essential for accelerating your progress toward financial independence.

Navigating Challenges and Setbacks

The FIRE journey is not always smooth sailing. You will likely encounter challenges and setbacks along the way. It’s important to be prepared for these obstacles and have strategies in place to overcome them.

Let’s look at some common challenges and how to navigate them effectively.

Dealing with Market Volatility

The stock market can be unpredictable, and downturns are inevitable. During periods of market volatility, it’s important to stay calm and avoid making impulsive decisions. Remember that investing is a long-term game, and short-term fluctuations are a normal part of the process.

Here are some tips for dealing with market volatility:

- Stay Diversified: Ensure your portfolio is well-diversified across different asset classes.

- Don’t Panic Sell: Avoid selling your investments during market downturns, as this can lock in losses.

- Rebalance Your Portfolio: Periodically rebalance your portfolio to maintain your desired asset allocation.

Staying Motivated

The FIRE journey can be a long and challenging one, and it’s easy to lose motivation along the way. Here are some tips for staying motivated and committed to your goals:

- Celebrate Milestones: Acknowledge and celebrate your progress along the way.

- Join a Community: Connect with other like-minded individuals for support and encouragement.

- Refocus on Purpose: Remember why you started your FIRE journey and the benefits it will bring to your life.

The FIRE journey requires resilience and adaptability. By anticipating challenges and developing strategies to overcome them, you can stay on track toward achieving your financial goals.

Living in Retirement

Retiring early is a significant accomplishment, but it’s important to have a plan for how you’ll spend your time and maintain your financial security in retirement. This phase requires careful management and planning.

Let’s discuss how to navigate the challenges and possibilities of living in retirement.

Managing Your Finances in Retirement

Even in retirement, it’s important to monitor your spending and make adjustments as needed. Creating a retirement budget helps to stay on track. Also have a strategy for making withdrawals from investment accounts in a tax-efficient manner.

Tax strategies might include:

- Consulting with a financial advisor for advice on how to minimize your tax liability.

- Strategies with Roth IRA conversions to reduce future tax burdens.

Finding Meaning and Purpose

It is important to find activities that give you a sense of purpose. Common routes include volunteering or pursuing hobbies.

It’s very important to give yourself opportunities to stay socially active. Common ideas:

- Taking classes or workshops for mental stimulation and learning.

- Travel opens your mind to new experiences and cultures, enhancing retirement.

Retirement can be a fulfilling and enriching chapter of your life if you approach it with careful planning and a clear vision for your future.

To conclude, navigating the unique landscape of retirement requires careful attention to both your financial well-being and your overall sense of purpose so that time is spent in a fulfilling, exciting way.

| Key Point | Brief Description |

|---|---|

| 💰 Savings Rate | Maximize savings by tracking expenses and automating savings. |

| 📈 Investment Diversity | Diversify investments across stocks, bonds, and real estate for stability. |

| 🎯 Realistic Goals | Set SMART goals, determine your FIRE number, and choose a suitable FIRE strategy. |

| 🧘 Maintaining Motivation | Celebrate achievements, involve a community, and remember your ‘why’. |

Frequently Asked Questions

▼

The 4% rule suggests you can withdraw 4% of your portfolio each year without running out of money, helpful for calculating your FIRE number. This number acts as a target to retire early.

▼

Track your spending to cut unnecessary expenses, automate savings transfers, and seek opportunities to increase your income through promotions or side hustles. Every little bit helps!

▼

Lean FIRE focuses on frugality, Fat FIRE aims for luxurious retirement, and Barista FIRE combines part-time work with investment income. Select is what best fits your comfort zone.

▼

Stay calm, keep your portfolio diversified, avoid panic selling, and periodically rebalance your investments. Market downturns are normal, so a steady plan matters.

▼

Manage your finances, engage in meaningful activities like volunteering or hobbies, stay socially active, and prioritize your health. Don’t become complacent once you reach your goal.

Conclusion

Embarking on the FIRE journey opens the door to a life of financial independence and early retirement. By understanding the principles, setting realistic goals, and developing a sustainable plan, you can pave your way to a future where you control your time and resources. While challenges are inevitable, staying focused on your goals will guide you toward achieving the financial freedom you desire.