Retirement Planning: Savings Goal by Age 40 in the US

Retirement planning by age 40 in the US requires a strategic approach, typically aiming to save at least three times your current annual salary to stay on track for a comfortable retirement.

Are you on track with your retirement planning: how much do you really need to save by age 40? It’s a question many Americans are asking, and the answer can significantly impact your future financial security. Let’s explore this crucial milestone and what it takes to reach it.

Understanding the Importance of Retirement Planning by 40

Reaching age 40 is a significant milestone in life, and it also marks a crucial point in your retirement planning journey. By this stage, you should have a clearer picture of your career trajectory, financial habits, and long-term goals. This understanding is essential for setting realistic and achievable retirement savings targets.

Retirement planning isn’t just about accumulating wealth; it’s about securing your future and ensuring a comfortable lifestyle during your golden years. Starting early and staying consistent with your savings and investment strategies can make a substantial difference in the long run. It’s about being proactive and taking control of your financial destiny.

Let’s delve into why hitting certain retirement savings milestones by age 40 is so crucial.

Why Age 40 is a Critical Juncture

By age 40, you’ve had a significant amount of time to build your career and establish financial stability. Here’s why this age is a pivotal point for retirement planning:

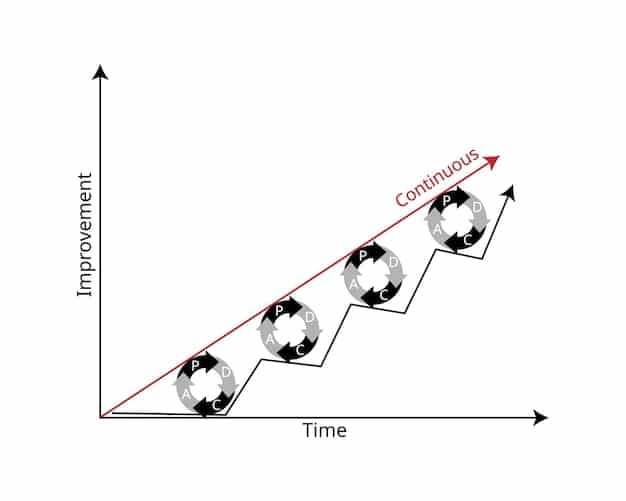

- Compounding Returns: You still have a substantial amount of time for your investments to grow through compounding. Starting earlier allows you to take full advantage of this powerful financial tool.

- Time to Correct Course: If you’re behind on your savings, age 40 provides a reasonable window to make necessary adjustments to your savings and investment strategies.

- Peak Earning Years: Many individuals experience their peak earning years in their 40s and 50s, making it an ideal time to aggressively save for retirement.

- Financial Responsibilities: By this age, you may have significant financial responsibilities such as mortgages, children’s education, and other long-term commitments. Planning ahead ensures these obligations don’t derail your retirement savings.

In conclusion, understanding the importance of retirement planning by age 40 sets the stage for making informed decisions and taking proactive steps toward securing your financial future. It’s a time to assess your progress, adjust your strategies, and commit to long-term financial well-being.

Assessing Your Current Retirement Savings

Before determining how much you need to save, it’s essential to assess your current financial status. This involves looking at your existing retirement accounts, debts, and overall financial health. Knowing where you stand today is the first step in charting a course toward your retirement goals.

Take the time to gather all your financial documents, including statements from your 401(k), IRA, and any other investment accounts, as well as records of your outstanding debts. This comprehensive overview will provide clarity and help you make informed decisions.

Gathering Your Financial Information

Start by compiling the following:

- Retirement Account Balances: 401(k)s, IRAs, and other retirement accounts.

- Investment Portfolio: Stocks, bonds, mutual funds, and other investments.

- Outstanding Debts: Mortgages, student loans, credit card debt, and other liabilities.

- Current Income: Your annual salary and any other sources of income.

Calculating Your Net Worth

Net worth is a key indicator of your financial health. Calculate it by subtracting your total liabilities (debts) from your total assets (retirement accounts, investments, savings, and other valuable possessions). A higher net worth generally indicates a stronger financial position.

Analyzing Your Spending Habits

Understanding where your money goes each month is crucial for identifying areas where you can save more. Track your expenses using budgeting apps, spreadsheets, or traditional methods. Categorize your spending to see where your money is going and identify potential areas for reduction. This analysis will help you understand your cash flow and make informed decisions about your savings strategy.

Assessing your current retirement savings provides a clear picture of your financial standing, enabling you to set realistic goals and make informed decisions about your future. Taking this crucial step is the cornerstone of effective retirement planning.

How Much Should You Have Saved? The 3x Salary Guideline

A common guideline suggests that by age 40, you should aim to have saved approximately three times your current annual salary for retirement. This benchmark provides a tangible goal and helps ensure you’re on track to maintain your current lifestyle in retirement.

Keep in mind that this is just a guideline, and individual circumstances can vary. Factors such as lifestyle expectations, family responsibilities, and risk tolerance can influence the amount you need to save. However, the 3x salary guideline offers a valuable starting point for assessing your progress.

Understanding the 3x Salary Rule

The 3x salary guideline is based on several factors:

The idea is that having three times your salary saved by age 40 positions you well to reach your retirement goals, assuming consistent savings and investment growth.

Factors That Influence Your Savings Goal

- Lifestyle Expectations: Do you plan to travel extensively, pursue hobbies, or maintain a lavish lifestyle in retirement?

- Family Responsibilities: Will you need to support dependents, contribute to college funds, or cover healthcare expenses?

- Risk Tolerance: Are you comfortable with higher-risk investments that could yield greater returns, or do you prefer a more conservative approach?

- Retirement Age: When do you realistically plan to retire?

Adjusting the Guideline for Your Situation

The 3x salary guideline is a general benchmark, but it’s essential to tailor it to your individual situation. If you plan to retire early, have significant debt, or anticipate high healthcare costs, you may need to save more aggressively. Conversely, if you have a generous pension or other sources of retirement income, you may be able to save less.

The 3x salary guideline provides a valuable benchmark for assessing your retirement savings progress. By understanding its origins, considering individual factors, and adjusting the guideline to your situation, you can create a personalized savings plan that aligns with your goals and circumstances.

Strategies to Catch Up If You’re Behind

If you find yourself behind on your retirement savings goal by age 40, don’t panic. There are several strategies you can implement to catch up. The key is to take immediate action and commit to a disciplined savings plan. Small changes can make a big difference over time.

Assess your current financial situation honestly and identify areas where you can make improvements. This could involve reducing expenses, increasing income, or adjusting your investment strategy. The sooner you start, the better your chances of reaching your retirement goals.

Increase Your Savings Rate

One of the most effective ways to catch up on retirement savings is to increase your savings rate. Even a small increase in your monthly contributions can have a significant impact over the long term. Consider these options:

- Automate Contributions: Set up automatic transfers from your checking account to your retirement accounts to ensure consistent savings.

- Take Advantage of Employer Matching: If your employer offers a 401(k) match, contribute enough to receive the full match. This is essentially free money.

- Adjust Your Budget: Identify areas where you can cut back on expenses and redirect those funds to your retirement savings.

- Increase Savings Gradually: Increase your contribution rate by 1% or 2% each year until you reach your desired savings level.

Optimize Your Investment Strategy

Review your investment portfolio to ensure it aligns with your risk tolerance and long-term goals. Consider these strategies:

In conclusion, catching up on retirement savings requires a proactive approach. By increasing your savings rate, optimizing your investment strategy, and diversifying your income streams, you can regain lost ground and secure a comfortable retirement.

Creating a Realistic Retirement Budget

A realistic retirement budget is essential for effective retirement planning. It helps you understand your financial needs and ensures you have sufficient funds to cover your expenses throughout your retirement years. Creating a detailed budget allows you to anticipate challenges and make informed decisions.

Start by estimating your expenses in retirement, including housing, healthcare, transportation, food, and entertainment. Be realistic and account for potential unexpected costs. A well-thought-out budget is the cornerstone of a secure retirement.

Estimating Your Retirement Expenses

Begin by considering these key expense categories:

- Housing: Mortgage payments, property taxes, insurance, and maintenance.

- Healthcare: Medical insurance premiums, doctor visits, prescriptions, and long-term care.

- Transportation: Car payments, insurance, fuel, and public transportation costs.

- Food: Groceries, dining out, and meal preparation expenses.

- Entertainment: Hobbies, travel, and social activities.

Accounting for Inflation

Inflation erodes the purchasing power of your savings over time. It’s important to factor in inflation when estimating your retirement expenses. A general rule of thumb is to assume an average inflation rate of 2% to 3% per year. Adjust your budget accordingly to ensure your savings keep pace with rising costs.

Adjusting Your Budget as Needed

Retirement is a dynamic phase of life, and your budget may need to be adjusted as your circumstances change. Periodically review your budget to ensure it still aligns with your needs and goals. Be prepared to make adjustments as necessary to maintain your financial stability.

Creating a realistic retirement budget is a critical step in retirement planning. By estimating your expenses, accounting for inflation, and regularly reviewing your budget, you can ensure your savings will last throughout your retirement years.

Seeking Professional Financial Advice

Navigating the complexities of retirement planning can be challenging. Seeking professional financial advice can provide valuable guidance and help you make informed decisions tailored to your unique circumstances. A financial advisor can offer expertise and insights that enhance your retirement planning strategy.

Consider consulting with a certified financial planner (CFP) or other qualified financial professional who can assess your financial situation, develop a personalized retirement plan, and provide ongoing support and guidance. A professional advisor can help you stay on track and achieve your retirement goals.

Benefits of Working with a Financial Advisor

Here are some key advantages of seeking professional financial advice:

- Expertise and Knowledge: Financial advisors possess in-depth knowledge of retirement planning strategies, investment options, and tax regulations.

- Personalized Retirement Plan: An advisor can develop a customized retirement plan tailored to your specific goals, risk tolerance, and financial situation.

- Objective Advice: A financial advisor provides unbiased advice and helps you make informed decisions without emotional biases.

Questions to Ask Potential Advisors

When choosing a financial advisor, ask the following questions:

In summary, seeking professional financial advice is a valuable step in retirement planning. A financial advisor can provide expertise, personalized guidance, and ongoing support to help you achieve your retirement goals.

| Key Aspect | Brief Description |

|---|---|

| 🎯 Savings Goal | Aim to save 3x your annual salary by age 40 for comfortable retirement. |

| 📊 Assess Finances | Evaluate current savings, debts, and spending habits for realistic planning. |

| 📈 Catch Up | Increase savings, optimize investments, and consider extra income sources. |

| 💼 Professional Help | Consider consulting a financial advisor for personalized retirement strategies. |

Frequently Asked Questions (FAQ)

▼

Compound interest is crucial because it allows your earnings to generate their own earnings over time, accelerating growth significantly. Starting early maximizes this effect, creating substantial wealth by retirement.

▼

Even if you started saving later, don’t be discouraged. Increase your savings rate, explore catch-up contributions, and adjust your investment strategy. Consistent effort can still lead to a comfortable retirement.

▼

Yes, most retirement savings accounts offer tax advantages. Traditional 401(k)s and IRAs provide tax-deferred growth, while Roth accounts offer tax-free withdrawals in retirement. Understanding these benefits is crucial for effective planning.

▼

It’s advisable to review your retirement plan at least once a year, or whenever there are significant life changes such as job changes, marriage, or the birth of a child, to ensure it aligns with your current circumstances.

▼

Common mistakes include not starting early enough, underestimating expenses, not diversifying investments, and withdrawing funds prematurely. Being aware of these pitfalls can help you make smarter financial choices.

Conclusion

Retirement planning: how much do you really need to save by age 40? is a critical question that requires careful consideration and proactive planning. By understanding the importance of early savings, assessing your current financial status, and implementing effective savings strategies, you can secure a comfortable retirement and achieve your long-term financial goals.